2021 electric car tax credit irs

The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. In that situation those families may be eligible to receive additional money by claiming the 2021 Recovery Rebate Credit on their 2021 income tax return.

How Do Electric Car Tax Credits Work Credit Karma

1545-1374 Attachment Sequence No.

. Part I Tentative Credit. Plug-In Electric Drive Vehicle Credit IRC 30D. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks.

Once that number hits 0 there is no further benefits from. The exact amount varies depending on the vehicles battery capacity but electric vehicles have historically qualified for the full amount. In August 2021 the US.

Size and battery capacity are the primary influencing factors. We will update this page once this measure has been made legal. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up.

How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. The electric vehicle tax credit hasnt changed for the past three years. If after I complete all applicable input submissions in TT for 2021 and it results.

Beginning on January 1 2021. Filemytaxes November 1 2021 Tax Credits. Electric Cars Eligible for the Full 7500 Tax Credit.

2021 Volkswagen ID4 crossover. Notice 201367 Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30Dg Notice 2016-15 Updating of Address for Qualified Vehicle Submissions. Qualified two-wheeled plug-in electric vehicles expired for vehicles acquired after 2021.

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. February 11 2022 529 AM. Senate approved a nonbinding resolution to set a 40000 limit on the price of electric cars eligible for the current tax credit.

If you need more columns use additional Forms 8936 and include the totals on lines 12 and 19. However if you acquired the two-wheeled vehicle in 2021 but placed it in service during 2022 you may still be able to claim the credit for 2022. So how much is the federal tax credit worth.

Well stick with vehicles that get the full credit below but the EPA has a full list that includes the lesser credits. Table of Contents show. For the latest information.

So Ill pose a simple example that likely will apply to my individual circumstances. How much is the electric vehicle tax credit worth in 2021. The Internal Revenue Service IRS offers tax credits to owners and manufacturers of certain plug-in electric drive motor vehicles including passenger vehicles light trucks and two-wheeled.

Plug-In Electric Drive Vehicle Credit IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. The credit ranges from 2500 to 7500 depending on the size of your vehicles battery. Notice 2009-89 New Qualified Plug-in Electric Drive Motor Vehicle Credit.

Electric vehicle tax credit limits 2021. The Electric Vehicle Credit is a non refundable credit. For vehicles acquired after December 31 2009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity.

Attach to your tax return. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an additional 417 for each kilowatt hour of. The federal tax credit for electric cars has been around for more than a decade.

About Publication 463 Travel Entertainment Gift and Car Expenses. Do not report two-wheeled vehicles acquired after 2021 on Form 8936 unless the credit is extended. I have read conflicting opinions on how this tax credit is applied for given scenarios.

A Vehicle 1 b Vehicle 2. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Do not report two-wheeled vehicles acquired after 2021 on Form 8936 unless the credit is extended.

Qualified Electric Vehicle Credit. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Electric Vehicle Tax Credit 2021.

However if you acquired the two-wheeled vehicle in 2021 but placed it in service during 2022 you may still be able to claim the credit for 2022. You can get 7500 back at tax time if you buy a new electric vehicle. I purchased an EV in Aug21 that definitely qualifies for a 7500 Tax Credit.

Use a separate column for each vehicle. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. This means that it can take your tax liability down to 0 but not less than 0.

Electric cars are entitled to a tax credit if they qualify. Plug-in hybrids tend to qualify for tax credits corresponding to their reduced all-electric range. Names shown on return.

Claim the credit for certain alternative motor vehicles on Form 8910. The value of the IRS tax credit ranges from 2500 to 7500 depending on the electric vehicle in question. As of August 2021 the US Senate through a non-binding solution has approved a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit.

Use this form to claim the credit for certain plug-in electric vehicles. Additionally this would set an income limit for buyers to 100000. Credit for two-wheeled vehicles.

November 2021 Department of the Treasury Internal Revenue Service. Use this chart to find your credit amount. Eligible vehicles such as EVs can qualify for up to 7500.

The credit for qualified two-wheeled plug-in electric vehicles expired for vehicles acquired after 2021.

Does The Rivian R1s Suv Qualify For The Federal Ev Tax Credit

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Commercial Ev Fleet Calculator And Transportation Electrification Tools

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Gift Electric Car To Spouse Get Tax Credit Internal Revenue Code Simplified

Latest On Tesla Ev Tax Credit June 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How To Calculate The Federal Tax Credit For Electric Cars Greencars

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Vehicle Tax Credits What You Need To Know Edmunds

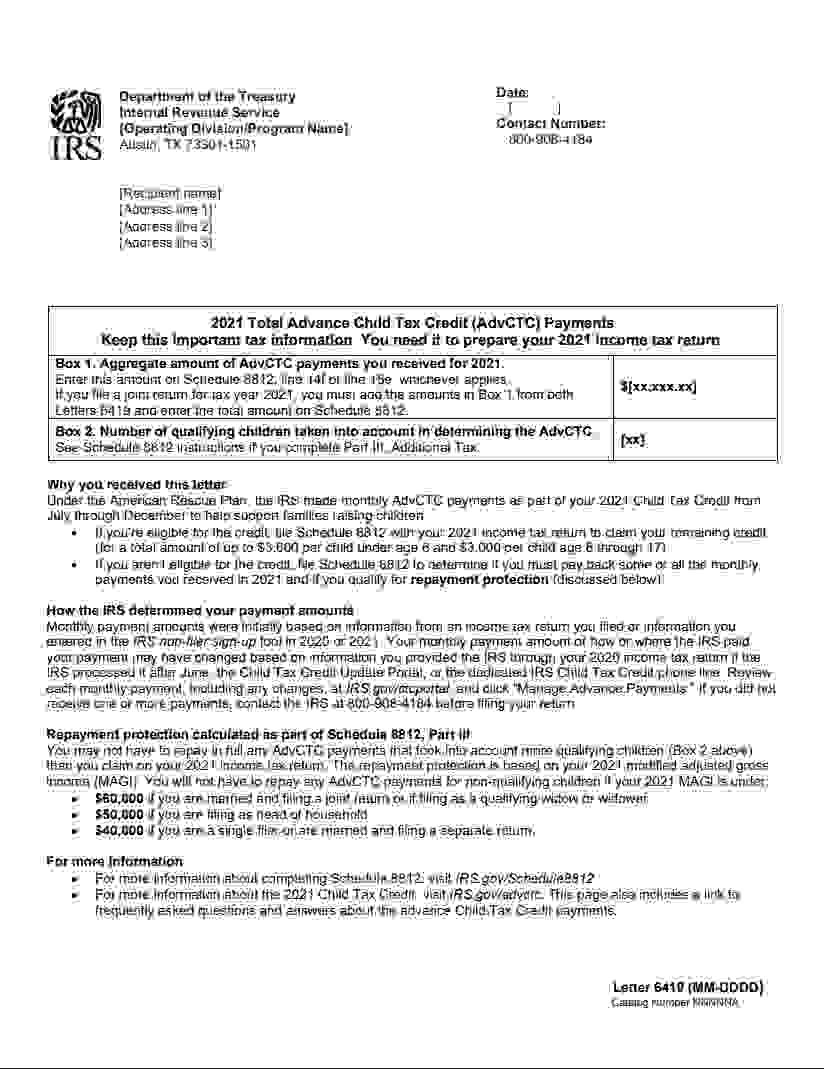

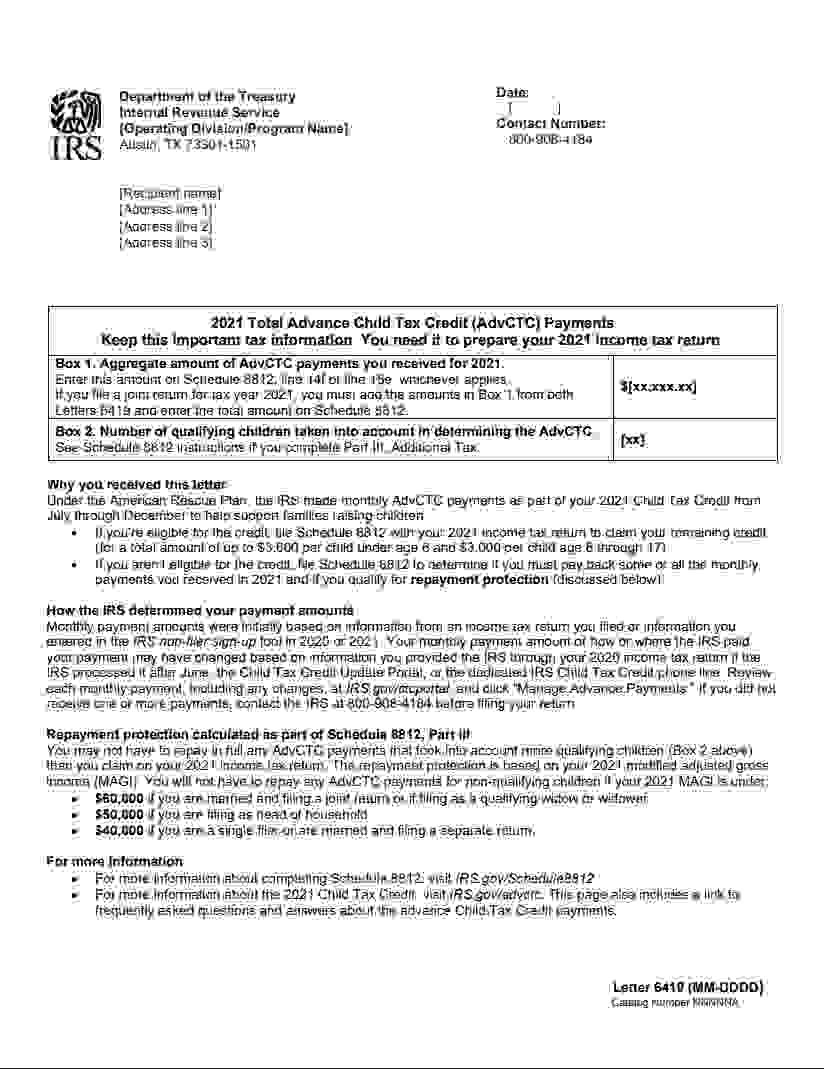

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

These 28 Electric Cars Qualify For A Tax Credit The Plugin Report

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek